Are vaccinations affecting crypto markets?

Well, it’s been a long time between drinks.

We haven’t published anything in quite a while as the market madness over the last year has kept our hands full.

Every now and then, we hope to push out something interesting that we are also analyzing internally. Hopefully we can be a bit more consistent in the future especially while markets are cooling off for the time being.

Ruffer noted something really interesting on BTC that we want to explore.

ICYMI, a large UK-based traditional asset manager with AUM of around US$22b recently took a large bet on Bitcoin. The initial trade of $600m long in around November banked them a profit of over $1billion by April this year, with most (if not all) realized.

What we find interesting however is their rationale for pulling the plug.

“it sold up partly because younger people wouldn’t be spending so much time trading now that the lockdowns are ending”

Here at Astronaut, we have always raised the possibility that this could be a catalyst for markets (not just crypto), to cool off for quite some time. This statement by one of the largest (recent) institutional traders has now given us the kick in the ass we need to look into it a bit more.

Whether Ruffers’ reasoning for exit is honest or if it is simply an excuse to satisfy the journalists, we think this has been largely overlooked for not only the crypto market, but macro markets in general.

Has lockdown driven retail to gamble?

I think we can all agree that the answer to this is likely yes.

But just to give you an idea of the explosive growth, here are some super quick facts.

Gambling Growth

The growth stats below are for online search of Gambling in the UK pre/post March 2020.

Punters on the ponies increased by over 12000% in the reported period followed closely by online poker.

(January to April 2019 and January to April 2020)

Source - Statista

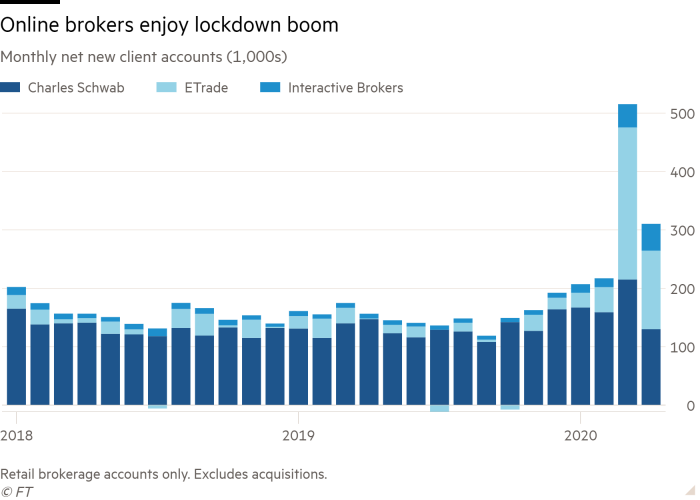

Equities options and brokerage account growth

Thanks to our friends at Wall Street Bets, options speculation amongst retail has gone parabolic in 2020.

Online brokers won more than anyone with record numbers of speculators signing up for new accounts.

Cryptocurrency volumes

We already know about the growth of crypto volumes over the last year, so no need to really expand on this.

Aggregated Spot Volumes below for your reference just in case you have been living under a rock.

So are vaccinations impacting markets?

Unfortunately, trusted vaccine data from both Russia and China is not easy to get your hands on.

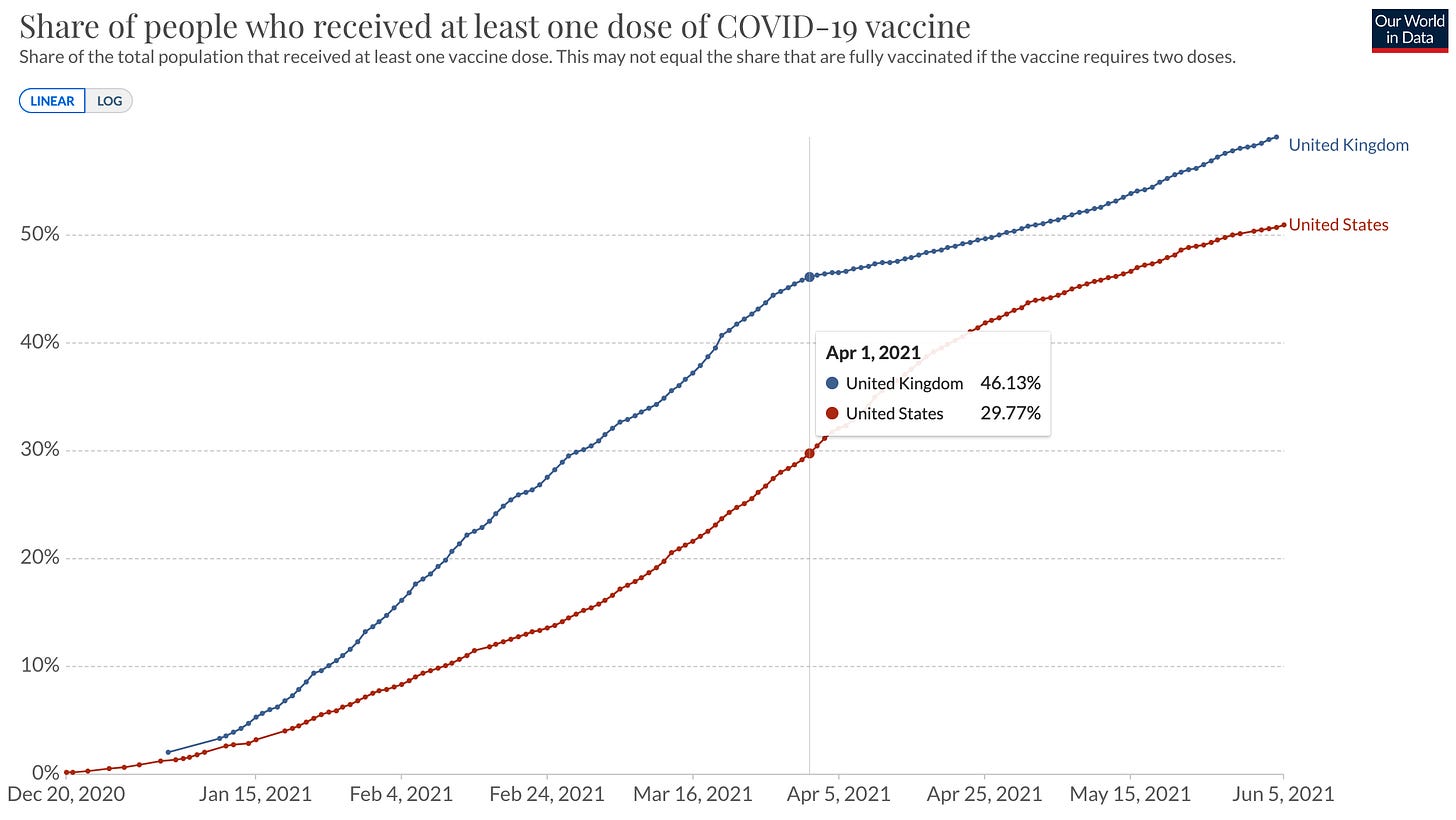

This being the case, we are utilizing two of the (other) largest trading geographies across markets. The USA and UK. All data since January 2021 when vaccines began rolling out.

Vaccinations since early January now cover over 50% per nation and are closing in fast to get to 100.

(Remember, there are two shots to have, so a lag exists in the data for full vaccinated)

I have also plotted the % vaccinated as of Ruffer’s exit from the market.

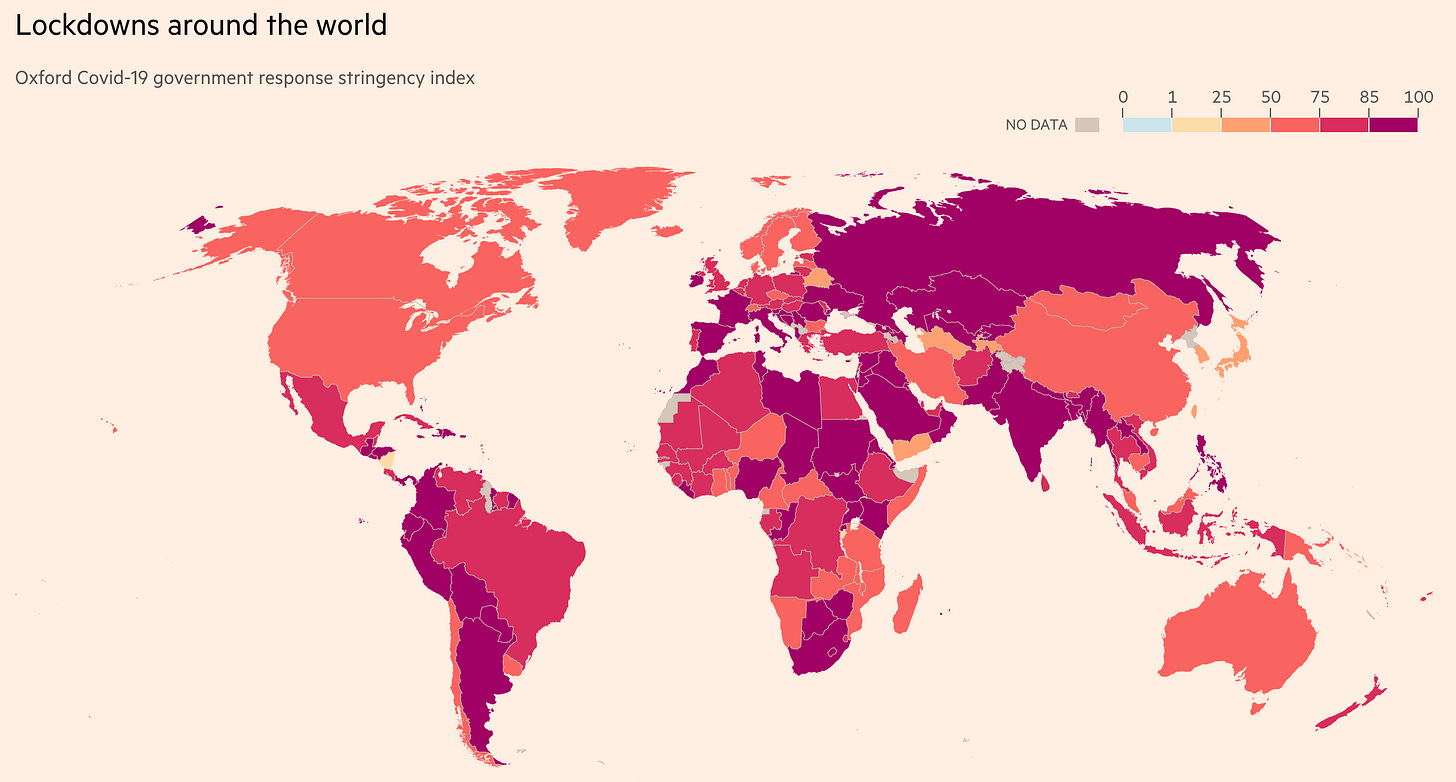

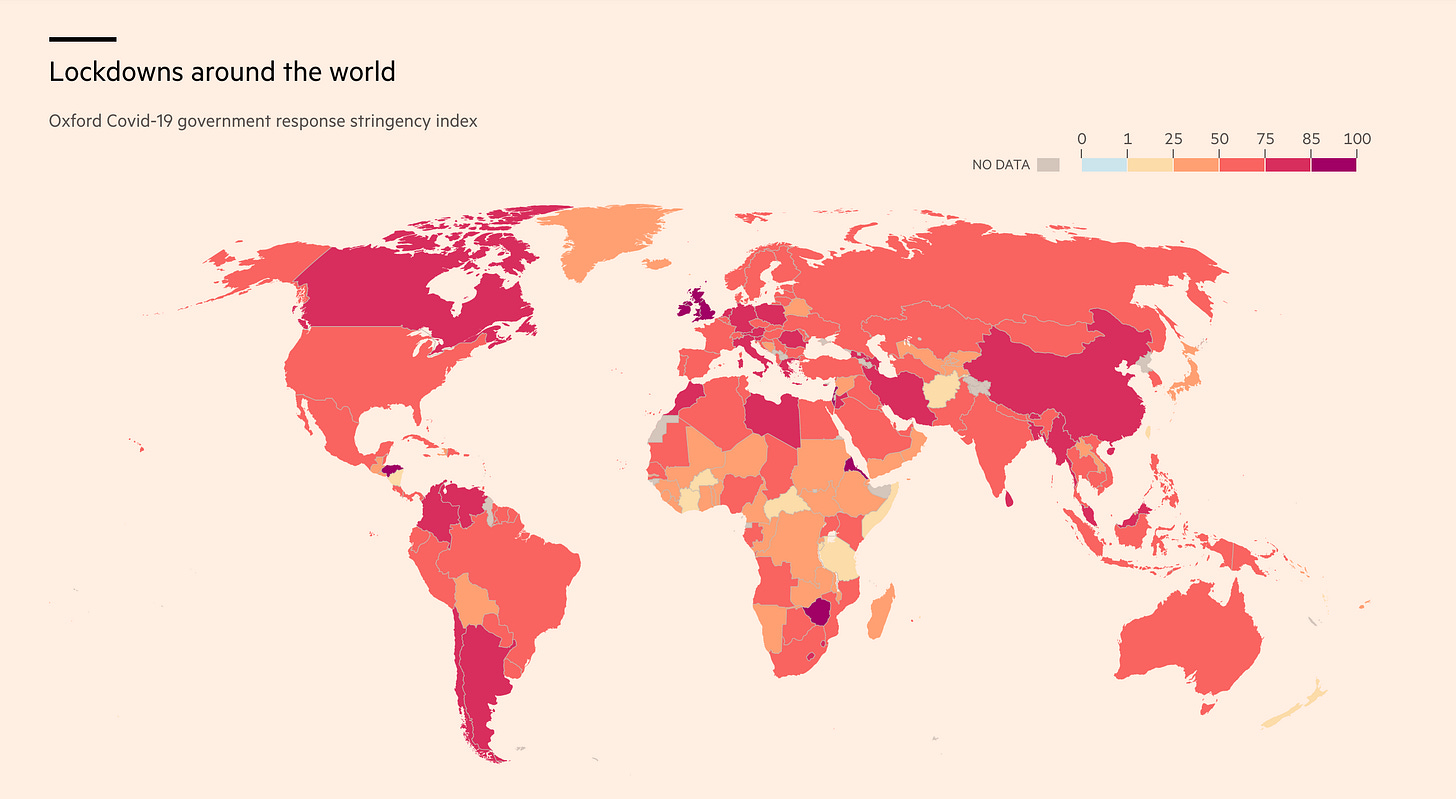

In addition to this, we now compare the ‘state of lockdowns’ globally. Fortunately, we can obtain better quality Russia and China data for these, which are a massive driver of retail flow.

Source - https://ig.ft.com/coronavirus-lockdowns/

April 2020 - Total armageddon

January 2021 - Vaccine rollout

April 2021 - One year after lockdown

Now that the world is opening up, we need to look at how this has affected volumes across certain asset classes in the last few months.

NASDAQ

The retail heavy Nasdaq had its peak volume in March 2021 for equities options trading and is now sitting around levels of November. Derivatives volume has consistently fallen since this peak despite the Nasdaq being about 3% off from all time highs. Matched equities data also shows a comparable trend.

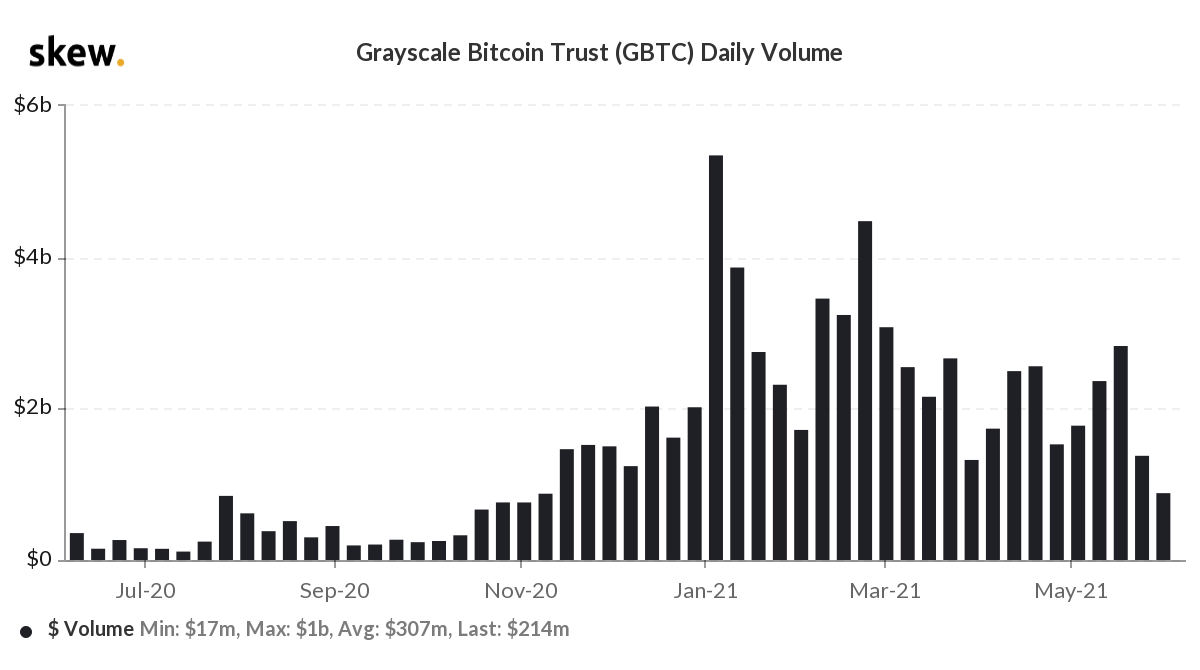

Crypto

GBTC Grayscale Bitcoin Trust has been recording much lower volumes (lower highs/lower lows for the TA fans) since its peak in January despite trading at a large discount to AUM. We like to show this chart because it is a common trading avenue for the uninitiated to the crypto world and a good indicator of newbie retail demand.

Spot aggregated data has also just recorded its lowest weekly volume since January.

Let’s throw in some Coinbase search data to make it interesting

So, whats the verdict?

From our point of view, it’s a little too early to tell. Some correlation exists, but it is not clear.

What we know is that:

Retail trading across crypto and all other derivative markets went parabolic since lockdowns began to occur

Liquidity has dropped considerably since various countries (including USA, Russia and China) have began to open up

Of course, we cannot discount the significant 40% drop across crypto in May, as this was bound to wipe out a good portion of the retail market and soften the sentiment for newcomers.

At the same time, evidence of declining liquidity and waning interest has been showing its head prior to the recent crash. What we can’t put our finger on yet is whether this is correlated directly to the opening up of certain geographies that are, historically, the largest retail trading markets across digital assets (USA Russia China).

In-house, we can see what Ruffer was eluding to and take the view that there will definitely be some impact on retail trading volume over the medium term, however to what extent remains to be seen.

We hope to update this in a few months as data becomes more reliable.

Stay safe,

Astronaut Capital

www.astronaut.capital

@astronautcap