Waiting for a pullback in Bitcoin? The art of selling Puts.

“Whoever wishes to win in this game must have patience and money, since the values are so little constant and the rumors so little founded on truth.”

- Joseph de la Vega , Confusion of Confusions (1688)

Happy New Year to our subscribers of Dark Pools. Just two weeks in to 2020 and we are already seeing some euphoria reminiscent of early 2018.

But with euphoria also comes FOMO (fear of missing out). As Bitcoin and select altcoins post massive gains for the week, many speculators are either a) looking to buy the hype, or b) are alternatively waiting for a pullback before getting reset at a lower average price.

This issue of Dark Pools is for those in camp b).

We are going to cover a common options strategy that allows you to get paid upfront for waiting on the Bitcoin pullback.

Most Investors Buy Puts if they are Bearish or if they want ‘Insurance’

A quick refresher on Buying Put options to start off:

Buying a Put option works like an insurance contract. By buying a Put with a strike price of $7000 and expiration date March 27, 2020 you have the right (but not the obligation) to sell 1 BTC on March 27, 2020 for 7000 Dollars no matter how low the spot price is on that day. Being long (buying) a Put is essentially a bet on falling prices.

If the price of BTC is lower than the strike price on the expiration date, you’ll exercise your option and sell BTC at the strike price of $7000. If the price is higher, the option expires worthless. Just like any other insurance contract, your Bitcoin insurance also doesn’t come for free. To buy this Put option, you’d have to pay a premium of roughly $250 right now.

Selling Put Options is where it gets interesting..

Instead of buying put options, the strategy we focus on today sells Put options in order to collect the above-mentioned premium.

This strategy has two benefits:

1) you don’t fall into the FOMO-trap and start chasing the currently bid-up prices only to go through a potential pullback again.

2) if the market cools down and prices fall to the strike price (or below), you will be exercised and forced to buy the underlying asset at the sold strike. This is a benefit if you were going to buy the asset anyway, because you also receive an upfront premium for the sale of the put (therefore lowering your entry price further to an extent).

The Patient Investor

An example..

Bitcoin is trading at around $9000, but in your belief, it has run too hard, too fast. You believe a pullback is in order, and you are happy to pay $8000 for a Bitcoin if it was to retrace.

To make things even clearer, let’s work with an example from Deribit.

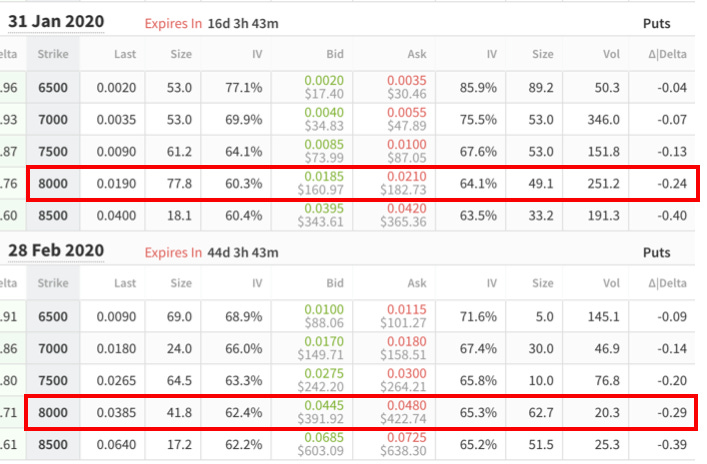

By selling an OTM (Out of the Money) Put option with 28 Feb expiration date and strike of $8000, the premium amounts to 0.0445 BTC or about $392. As long as prices hold above your breakeven point of $7608 (Strike price of $8000 minus premium of $392), the options strategy will be profitable. If prices fall below $7608, you will incur a loss with this strategy, as it would have been cheaper to acquire BTC at the prevailing spot price.

So instead of waiting on the sidelines or chasing the market, you get paid to wait for the market to pull back. While we believe that this is a favorable strategy for anyone looking to acquire more BTC at lower prices to HODL, keep in mind that you will be forced to buy the BTC at the option strike price even if prices drop substantially below it.

This is an accumulation strategy. Only use this strategy if you actually want to own the underlying asset.

To reduce the risk of assignment, a Put option with an earlier expiry date or a lower strike price can be sold. However, premium for these options will be lower, as the strike price and time until expiration are key inputs for pricing options. Eager investors can also look at ATM (at the money) puts with a higher risk of being assigned.

Options are complex derivatives so make sure you understand how the strike price, expiration date and volatility are affecting premium. Margin requirements for selling naked puts also differ across exchanges. To avoid further risks, make sure you’re only trading liquid contracts.

Good luck and stay safe out there.

P.S, we have written a bunch of articles about Bitcoin options. Check them out by clicking here.

Matt Dibb

Astronaut Capital

twitter: @mjdibb @astronautcap

Sharing is caring

About Astronaut Capital

Since 2017, Astronaut Capital has been one of the leading asset-managers for cryptocurrencies and digital assets. Utilizing its internal research team at Picolo Research and STO Rating, Astronaut operates long/short strategies to navigate the market on behalf of investors.

For subscription information about our investment funds, visit www.astronaut.capital or follow us on twitter.